Producers in some areas have experienced a perfect storm in 2018. After a delayed growing season, crops caught up and matured ahead of normal, only to have rain delay harvest. That opened the door to quality problems ranging from soybean pod shattering to mycotoxin contamination.

In fact, USDA’s Crop Progress report this week shows harvest in the 18 states behind average for all crops, and our service area is among those with crops still in the field:

| Corn

remaining (%) | Soybeans remaining (%) | Sorghum remaining (%) | Sunflower remaining (%) |

Iowa | 17 | 6 | -- | -- |

Kansas | 11 | 26 | 38 | 37 |

Nebraska | 23 | 6 | 15 | -- |

South Dakota | 29 | 4 | 25 | 45 |

Reporting states | 16 | 12 | 27 | -- |

Stacy Andersen, a crop insurance officer in the Farm Credit Services of America (FCSAmerica) Harlan, Iowa, office, says various customers were hit with corn green snap, hail, standing water and/or blackened soybeans. Damage from corn green snap was fairly widespread, ranging from light to more than 50 percent.

“We sent out postcards early in the harvest season regarding quality concerns and procedures, and we’ve been on the phone a lot,” she said.

“In our area, farmers are fighting beans shattering or appearing gray and moldy,” said Christa Wilson, FCSAmerica vice president, related services, in eastern Iowa.

Some soybeans that have turned black have proven to be acceptable to buyers, but when the discoloration extends through the bean, they have been rejected by elevators.

Crop Insurance Process

The crop insurance claim process differs depending on a producer’s situation, Wilson explained. For instance, the crop in a flooded field with standing water can’t be harvested for use as food. Producers have the option to sell to a salvage buyer if they can find one who will take the production, or they can destroy the crop and take a zero on their Actual Production History (APH).

A quality issue that the elevator discounts less than 8 percent doesn’t support an insurance claim. “We often see cases where the farmer believes damage to be 35 t0 40 percent but it turns out to be 10 percent,” Wilson said.

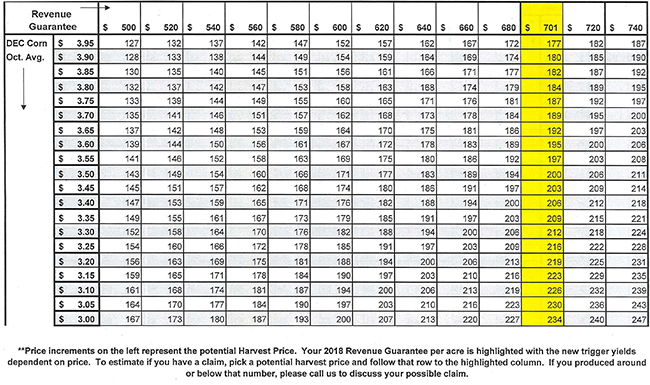

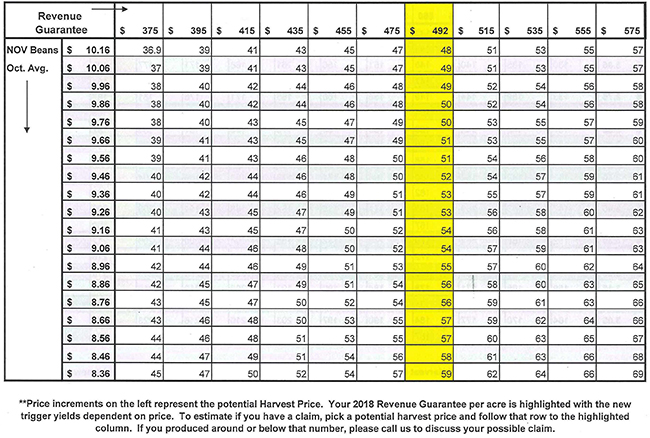

And while the price drop from the spring guarantee of $10.16 to the harvest price of $8.61 appears large, in almost all cases it would not produce a claim on its own, depending on the yield. The table below illustrates the yield needed to trigger a claim given various revenue guarantees. The October average falls between the $8.65 and $8.66 rows in the table. Click to run a trigger yield calculation using your values.

In all cases, producers need to weigh the impact on APH against the amount a claim might be worth.

“We can help identify the avenues you can use to ensure the impact on your APH is minimized,” Wilson said. “A bigger question this year is the effect on your Market Facilitation Program (MFP) payment.”

This one-time federal program for producers whose commodities are negatively impacted by trade disputes is paid strictly on the bushels produced. The first of two possible payments is $1.65 on half your production.

“So is it better to combine the crop to collect the 82 cents, plus a possible additional payment, or save the cost of combining and file a claim?”

Your FCSAmerica insurance team can help you make that determination – and guide you through the insurance claims process when quality is at issue.

For those who want to review before proceeding, click to view the USDA/Risk Management Agency fact sheet on Soybean Kernel Damage Quality Adjustment Procedure.