FCSAmerica will return a portion of our 2026 net income earned from eligible customers through the 2026 patronage program. The Board of Directors intends to target an annual cash-back dividend, barring unforeseen events and significant change in economic conditions.

-

Our offices will be closed on Mon., Feb. 16, in observance of Presidents’ Day.

Cash-Back Dividend Payments

This marks the 22nd consecutive year that FCSAmerica will return a share of its net earnings to eligible customer-owners. The 2025 cash-back dividend payout is more than $429 million for a cumulative return of more than $4.1 billion back to farmers and ranchers since 2004.

Our ability to consistently pay a cash-back dividend for 22 years and counting reflects remarkable financial strength. In fact, the Board of Directors intends to pay a cash-back dividend each year, barring any unforeseen events.

Recent Payout Numbers

Cash-back dividends are based on eligible loan volume and Association financial results. Prior distributions should not be interpreted as guarantees of future performance.

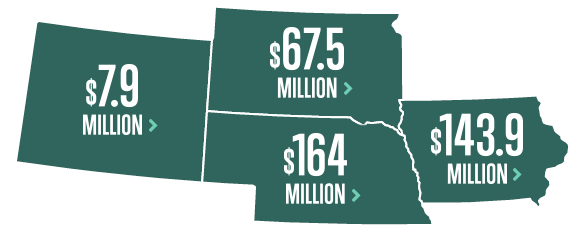

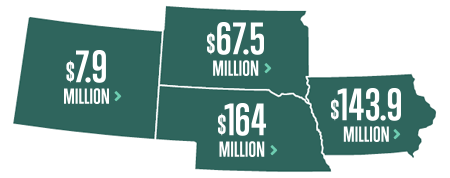

2026 Distribution Map

Cash‑back dividends paid in 2026 delivered meaningful value to customer‑owners across our territory. In total, we returned $164 million to customer‑owners in Nebraska, $143.9 million in Iowa, $67.5 million in South Dakota, and $7.9 million in Wyoming, with an additional $46.4 million distributed across other areas we serve.

Explore what has been paid in 2026 to our customer-owners in counties near you.

Select a state to see county‑by‑county cash‑back dividends paid in 2026.

Frequently Asked Questions

Cash-back dividends are a component of FCSAmerica’s customer value proposition and are one of the unique benefits of doing business with a customer-owned financial cooperative. Cash-back dividends are a way to reduce the cost of borrowing from FCSAmerica by sharing in the cooperative’s profits.

The amount of a customer’s 2026 patronage distribution will be based on his or her eligible average loan volume with FCSAmerica during 2026. Generally, the more a customer borrows from us, the more they will benefit financially, from the program. Because your eligible average loan volume and the amount of approved patronage can change each year, your cash-back dividend likely will change from one year to the next.

Yes. Eligible customers generally should include the cash-back dividend in their taxable income in the year that it was received. We encourage customers to consult with a tax advisor about their specific situation. Non-corporate customers will receive an IRS Form 1099-PATR early in 2027 for cash-back dividends paid in 2026. IRS regulations do not require distribution of 1099-PATR forms for corporations.

Retained earnings not distributed in cash-back dividends help FCSAmerica build the necessary capital to fund future growth and to develop new products and services that help you, our customer-owner, succeed.

The cash-back dividend payee will be the “payor of record” (primary customer) in our loan accounting system as of December 31, 2026. This is the same person whose taxpayer identification number appears on any IRS reporting associated with the customer’s account.

FCSAmerica is dedicated to providing industry expertise, quality customer service, and competitive rates. To attract investors for Farm Credit System funding, FCSAmerica must demonstrate the ability to generate strong earnings. The program allows FCSAmerica's Board to determine the amount of the cash-back dividend distribution after financial results for the year are known.

Our Board currently intends to distribute patronage each year. The Board and our financial plans currently target patronage distributions for the foreseeable future, barring unforeseen events and significant change in economic conditions. However, patronage may vary as the earnings and capital needs of the cooperative change.

Generally, customers whose loans are capitalized by stock are eligible for cash-back dividends. These loans include operating and agriculture real estate loans, as well as some consumer-purpose loans secured with real estate (see excluded products below).

If a customer has paid off a loan, he/she is eligible for patronage for the period the loan was outstanding, provided it was capitalized at the time of payoff and no exclusions to eligibility apply.

Who is ineligible for cash-back dividends?

- Non-accrual loans past due as of December 31.

- Forbearance or restructured loan agreements that include patronage waivers.

- Charge-offs (net), partial or full. All the customer’s loans are ineligible for seven years from the date of most recent charge-off, unless fully recovered, including any loans originated subsequent to the charge-offs.

- Bankruptcy, voluntary or involuntary. All the customer’s loans are ineligible for seven years from the date of discharge or similar proceeding and concluding on December 31st of that seventh year.

- Sales contract (Contract for Deed) resulting from a restructured loan.

- Accelerated loans as of December 31. One accelerated loan makes all the customer's loans ineligible.

- A loan participation or multi-lender syndicated loan unless the contract with the borrower specifically provides for the payment of patronage.

- A sold loan participation where the contract with the purchasing institution specifically designates the loan as a non-patronage loan.

- A loan made expressly on a non-patronage basis.

- Cash-back dividends of less than $50.

Excluded products

- Crop insurance, as required by regulations, prohibits the distribution of insurance income directly to customers who generate it.

- Leasing, as required by the lease agreement with our lease processor, Farm Credit Leasing.

- AgDirect equipment financing made after April 11, 2010.

- Certain Young and Beginning program loans.

- Paycheck Protection Program (PPP) loans made through the U.S. Small Business Administration.

- Consumer-purpose loans secured by real estate:

- Closed on or after January 1, 2018.

- With a completed loan servicing action on or after January 1, 2018, for the following*:

- All interest rate conversions

- Maturity/Extension of Terms greater than 3 months

- Payment Extensions or Deferments

- An additional advance closed on or after April 15, 2018.

Cash-back dividends are based on eligible loan volume and Association financial results. Prior distributions should not be interpreted as guarantees of future performance.

Get Started

Connect with a local office or contact us for more information.