The two main legs of crop income every year are Price X Bushels. Crop insurance provides a third leg and government payments a fourth.

In its September 12 Crop Production report, USDA forecast record corn and soybean yields for 10 states and the nation.

While federal ARC payments are expected to be minimal this year, as intended by the 2014 Farm Bill, the government is offering direct payments under a one-time Market Facilitation Program (MFP) to producers whose commodities are negatively impacted by trade disputes. In our territory, the MFP will benefit soybean, grain, hog and dairy farmers.

USDA last week announced MFP commodity rates and the rules and process for applying for payment. Unknown until producers have completed harvest or know their final production numbers is how much impact MFP payments will have on individual 2018 farm incomes. But simple scenarios involving two hypothetical farmers shed some light on the benefit of MFP payments.

For our scenarios, we applied MFP to soybeans. Our assumptions are straightforward and do not take into account the complexities and realities of day-to-day production. We use a production cost of $9.50/bu., or $475 an acre and an APH of 50 bu., with our producer having sole ownership of his crop.

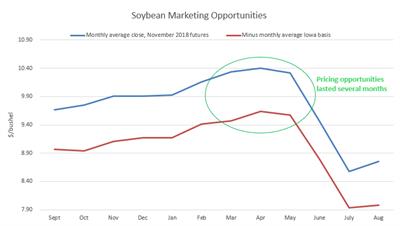

For sales prices, we used monthly average November 2018 futures prices and subtracted Iowa monthly average basis. The resulting $7.75 and $9.50 are for illustrative purposes and may not fit your specific situation.

In the first scenario, everything goes right for our producer. He knows his all-in production cost and took advantage of the $9.50 pricing opportunity earlier this year, relying on his crop insurance to forward market 80 percent of his APH to lock in $380 an acre. Because he benefited from the year’s good growing conditions, he actually harvests 60 bu./acre. This leaves him 20 bu. to sell at a lower price of $7.75 for $155 per acre.

Our farmer already has made a profit of $60, thanks to his forward marketing and solid yield. Now he applies for his MFP payment. As required by USDA, he reports his total yield of 60 bu./acre. But under this first installment of MFP, the government applies its reimbursement rate of $1.65 for beans to half his yield – or $49.50. Our producer’s per-acre profitability is now $109.50. His profitability will increase if the government decides later this year that a second payment is warranted.

In scenario No. 2, our producer did not forward market and has an average yield of 50 bu./acre. He needs the cash and sells his crop at $7.75, or $387.50 per acre – a loss of $87.50. Even after applying his MFP payment (25 bu. x $1.65 = $41.25), he has lost $46.25 per acre.

This scenario becomes much more positive if farmer No. 2 grows another 10 bu./acre, a reasonable assumption for many growers this year. With more beans to sell and to apply to his MFP payment, he now has a per-acre profit of $39.50.

What do these scenarios tell us? Producers with a reasonable cost of production and solid yields could bushel through 2018, with some additional help from MFP.

Market Facilitation Program: What You Need

- Applicants must be actively engaged in production, have ownership interest, an average adjusted gross income of less than $900,000 for tax years 2014 through 2016 and be in compliance with conservation regulations as they apply to their operation.

- Form CCC-910 can be submitted through January 15, 2019. Payments are taxable in the year received. Delay submitting actual productions to FSA until early January if you want to be taxed in 2019 on any MFP payment.

- Crop payments are based on current 2018 production, meaning growers must wait until they have completed harvest to report their yields for each crop. Hog payments are based on the number of owned live hogs as of August 1, 2018. Payment for dairy is based on historical production reported to the Margin Protection Program for Dairy (MPP-Dairy), established with the operation’s highest annual milk production between 2011 and 2013. To be eligible, dairies must have been in operation on June 1, 2018.

- Expect to provide supporting documentation of production, such as receipts, ledgers of income, register tape, etc.

- MFP payments are capped at $125,000 per person or legal entity. But the cap is applied differently for crops and livestock – $125,000 for all crops combined and separately for livestock. This means producers with crops and livestock can receive more than $125,000.

Commodity | Payment Rate |

Corn | $0.01 per bushel |

Dairy | $0.12 per hunderweight |

Pork | $8.00 per head |

Sorghum | $0.86 per bushel |

Soybeans | $1.65 per bushel |

Wheat | $0.14 per bushel |