Farm Credit Services of America (FCSAmerica) and Frontier Farm Credit are co-sponsoring a webinar series, Two Economists and a Lender. Our March installment featured Agriculture Economic Insights (AEI) co-founders David Widmar and Brent Gloy and Senior Vice President of Related Services, Christa Wilson, discussing three tools that can help producers better manage the uncertainty of weather. Below are highlights from their discussion.

Weather is one of the biggest uncertainties in agriculture. With the approach of a new growing season, our experts outline three approaches that can help producers think through their weather-related risks and how to manage them.

OODA Loop

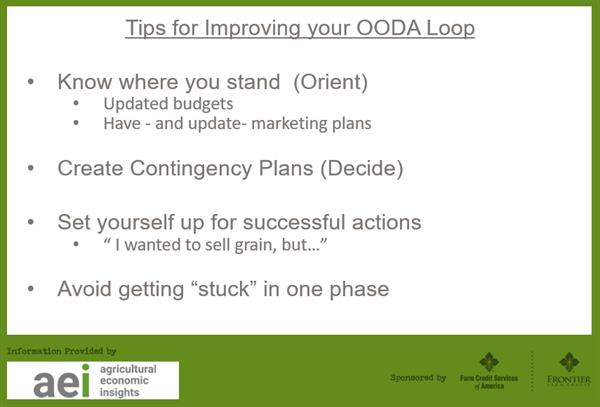

An acronym for “observe, orient, decide, act,” OODA comes from the U.S. Airforce. During the Korean War, an Airforce officer wanted to know what set the top fighter pilots apart. The answer lay in their ability to quickly observe all the factors and events around them, orient themselves within that setting, weigh their options and decide on the right course, and finally, position themselves to act.

An acronym for “observe, orient, decide, act,” OODA comes from the U.S. Airforce. During the Korean War, an Airforce officer wanted to know what set the top fighter pilots apart. The answer lay in their ability to quickly observe all the factors and events around them, orient themselves within that setting, weigh their options and decide on the right course, and finally, position themselves to act.

For producers, observation might begin with forecasts, conditions in the field and a review of historical data, such as planting days be year. If, like this year, signs point to a wet spring, ask yourself some key questions to orient yourself, suggested David Widmar: Did you get fall fertilizer down? What about your spring treatment? If you already are a bit behind, what will it take to catch up?

Now you can consider your options, including running longer hours, hiring someone for custom work, adjusting plans, such as side-dress after the crop comes up, or depending on the timing, shift to prevent or late planting or change planting plans all together. By listing the options, producers can better identify the right course of action, then execute on it.

”Producers who move themselves through those four steps are going to be able to make decisions much more quickly and responsively to the environment they are in,” Widmar said.

Triangulation

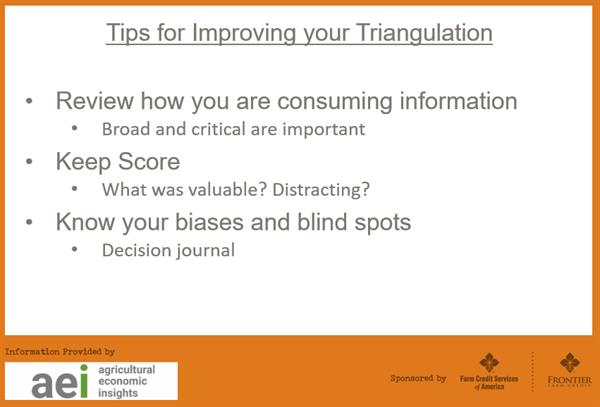

No producer is an expert in all the disciplines required to run an agricultural operation. That’s why it is so important to have advisors. The triangulation approach also emphasizes the need to broaden your sources of information and to seek out different viewpoints.

No producer is an expert in all the disciplines required to run an agricultural operation. That’s why it is so important to have advisors. The triangulation approach also emphasizes the need to broaden your sources of information and to seek out different viewpoints.

“I love to read stuff that I agree with because it tells me I’m right,” Gloy said. “But it also causes me to have a huge blind spot for places where I’m not right. And we all know we’re not right all the time. So think pretty critically about where you’re getting information and how you are consuming it.”

Gloy urged producers to use a decision journal, discussed in the Thinking Critically About Uncertainties in 2020 webinar, to track their sources of information, what they found useful and what led to indecision. This process will help producers identify their blind spots and the resources they can tap to improve decision-making.

Controllable vs. Uncontrollable

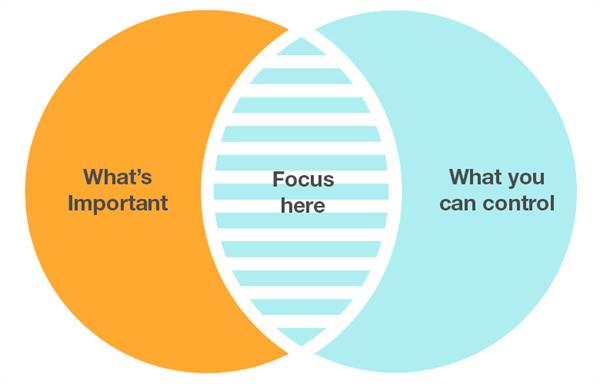

Many of the important factors that shape an operation – weather, markets, trade – also are outside a producer’s control, said Christa Wilson, one of our regional vice presidents for related services, including crop insurance. In her family’s farming operation, she said, she finds it useful to list what is important as well as what is controllable (the type of seed you buy, for example).

Often what you end up with, Wilson said, is a narrow band in the center of two circles – those things that are both important and controllable. This, she said, is your area of focus. You might not be able to control the weather, but you can work with your crop insurance agent to identify the right coverage to protect your operation and maximize your marketing plan.

Often what you end up with, Wilson said, is a narrow band in the center of two circles – those things that are both important and controllable. This, she said, is your area of focus. You might not be able to control the weather, but you can work with your crop insurance agent to identify the right coverage to protect your operation and maximize your marketing plan.

“Being price takers, not price makers, being weather takers, not weather makers, we need to focus on those things that we can control,” Wilson said.

Below is the entire webinar.