Agricultural outlook for Q1 2026 from Terrain™, our service for agricultural insights. Author Dave Weaber is Terrain’s senior animal protein analyst. This article originally appeared on TerrainAg.com.

Report Snapshot

Situation

Placements of cattle into feedlots continue to shrink, long-feared beef slaughter capacity reductions have arrived, and the beef cow herd hasn’t begun to expand.

Finding

Managing price risk and preserving equity is critically important as opposing market forces add to price volatility and producer uncertainty.

Outlook

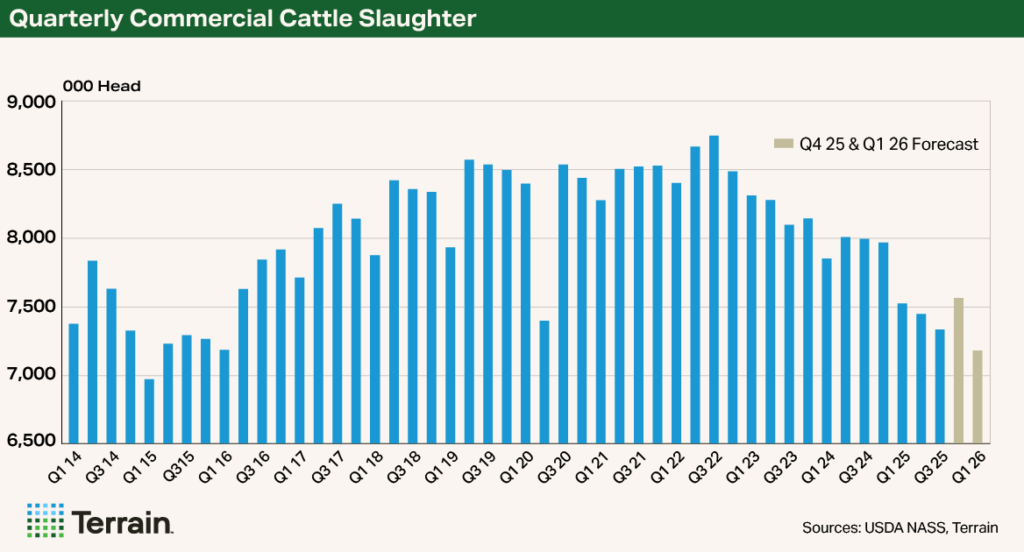

I project fed cattle supplies will contract in Q1 2026. Prices for all classes of cattle and beef will likely rebound into spring but remain in a highly volatile environment. Even with a 2% shift in leverage to the packers’ favor, I expect the choice cutout to average between $375/cwt and $385/cwt and fed cattle prices to average between $234/cwt and $238/cwt in Q1.

The long-feared rightsizing of shackle spaces to more closely match the number of cattle has begun. The market’s reaction to the November announcement was a good reminder that market volatility still exists even when the supply and demand fundamentals continue to be positive forces into the start of 2026.

Plant Closures Have Wide-Ranging Effects

In late November, a major Nebraska fed cattle plant announced it will close in mid- to late January and a double-shift plant in Texas announced it will go to one shift per day. Terrain estimates the changes will eventually reduce U.S. slaughter capacity by about 6.6%. However, slaughter plant capacity utilization is still nearly 6% behind historical norms, as the number of cattle is still well short of filling available slaughter capacity.

This positive shift in operational efficiency will likely encourage plants to fill available capacity and better compete for the available cattle.

I expect utilization to decline by about 2% during 2026 when two new plants in Nebraska and Missouri complete their startups. A proposed plant in the Panhandle of Texas that would handle 6,000 head per day has the potential to lower utilization rates back to early-2025 levels if completed. Even without additional future slaughter capacity, utilization rates will remain low; fed cattle numbers are expected to decline during the next two to three years because of cow-calf producers’ beef cow herd expansion efforts.

The reduction in current fed slaughter capacity will help the remaining plants run more volume, improving efficiency by spreading fixed and semi-variable costs across more head and pounds of beef. This positive shift in operational efficiency will likely encourage plants to fill available capacity and better compete for the available cattle.

I expect that in the near and intermediate term, this effect will at least partially offset the shift in market leverage, which currently favors the packer.

Markets and Beef Prices Remain Resilient

Beyond the near-term impacts to futures traders’ sentiment, the market impacts of the announced closures are fading. Calf, feeder cattle and fed cattle cash markets are already recovering and have posted significant rallies. Fed cattle supplies for the first half of 2026 are not going to change. The number of cattle placed into feed yards is the number placed and will be the number that gets slaughtered. The location the cattle get processed into beef may change, but overall beef production is mostly set.

Consumer beef demand and spending remain strong and supportive of cattle prices. Presidential and executive branch rhetoric about lowering beef prices has had little to no impact on retail and wholesale beef prices. Tariff reductions on imported lean trimmings from South America are driving volumes, but prices for contracted loads delivering in the first quarter of 2026 are record high, up 20% from a year earlier.

I expect the choice cutout to average between $375/cwt and $385/cwt and fed cattle prices to average between $234/cwt and $238/cwt in Q1.

Q1 2026 Price Outlook

I expect available fed cattle supplies during the first quarter of 2026 to be 6% to 7% smaller than the year prior. Even with a 2% shift in leverage (fed cattle price to comprehensive cutout) to the packers’ favor, I expect the choice cutout to average between $375/cwt and $385/cwt and fed cattle prices to average between $234/cwt and $238/cwt in Q1.

By early December, light feeder cattle and calf auction prices have recovered much of the losses incurred since late October and appear poised to start 2026 at record levels.

Changes to the U.S.-Mexico border status remain the greatest known risk for cattle prices.

Further rallies in deferred live cattle futures will drive the balance of the recovery in prices for heavy feeder cattle that make up the CME feeder cattle price index. Demand for light cattle to be turned out on plentiful wheat pasture and California coastal range has been a key driver for the rally in light cattle.

Biggest Risk Is South of the Border

Changes to the U.S.-Mexico border status remain the greatest known risk for cattle prices. The Mexican government has implemented broad cattle movement and import restrictions within the country as well as greater fly control measures in partnership with the USDA. Meanwhile, U.S. and Mexican officials have begun inspections of only one border crossing into New Mexico. Additional cases of New World screwworm have been found in Mexico, which I expect to further delay the reopening.

Active risk management to preserve operation equity should remain a priority.

If the border were to reopen, cash feeder cattle and calf prices and feeder cattle and live cattle futures would be the first to move down. The magnitude of the impact will depend on the rate-limiting and cost impacts of the protocols that are implemented and the number of backlogged cattle south of the border.

One Lesson From Plant Closures

If we’ve learned anything from the market reactions to the plant announcements, it’s that price volatility should be a focus for producers in all segments of the cattle industry. Active risk management to preserve operation equity should remain a priority.

Terrain™ content is an exclusive offering of AgCountry Farm Credit Services, Farm Credit Services of America, Frontier Farm Credit, and American AgCredit.

While the information contained in this site is accurate to the best of our knowledge, it is presented “as is,” with no guarantee of completeness, accuracy, or timeliness, and without warranty of any kind, express or implied. None of the contents on this site should be considered to constitute investment, legal, accounting, tax, or other advice of any kind. In no event will Terrain or its affiliated Associations and their respective agents and employees be liable to you or anyone else for any decision made or action taken in reliance on the information in this site.