Terrain™ is our service for timely insights on topics and trends impacting agriculture, delivered by a team of specialized economic and agriculture analysts. Additional Terrain articles can be found at TerrainAg.com.

Author Matt Erickson is a senior analyst focusing on macroeconomics and the grain, oilseed and swine sectors. Author Bree Baatz is a Terrain grain and oilseed analyst. Author Marc Rosenbohm is Terrain’s senior grain and oilseed analyst.

Key Takeaways:

- Weather, Acreage, and Tariff Uncertainty = Price Risk: A hot and dry summer forecast, changing planting data, and the looming expiration of U.S.-China tariff deal could greatly impact supply and demand fundamentals and drive price volatility.

- Global Corn Supply is Tight: Low stock levels globally make U.S. corn essential to meet rising demand – especially if trendline yields were to fall.

- Soybean Market is Tight But Faces Brazil Pressure: Brazil’s growing output and trade edge with China could challenge U.S. market share.

- Producers Need Flexible Risk Strategies for 2025: Volatile markets call for flexible management of price swings and markets.

As the U.S. corn and soybean balance sheets evolve this growing season, market dynamics will continue to influence supply and demand. The May WASDE report offered the first projections for the new marketing year, but future updates will incorporate ongoing changes in acreage, weather and global economic conditions – which ultimately influence demand.

Between the USDA’s June Acreage Report and the National Weather Service’s summer outlook—which forecasts above-average temperatures and below-average precipitation across much of the Midwest—uncertainty persists around planted acres and yield potential for both corn and soybeans.

Compounding this uncertainty, demand for both crops remains volatile. The following factors could drive significant changes in U.S. corn and soybean demand in the next few months:

- Global trade dynamics

- Fluctuations in the U.S. dollar

- Ambiguity surrounding biofuel policy

- Shifts in domestic and international meat production

- Weather developments in South America

Given these conditions, how will changes in acreage and yield affect corn and soybean ending stocks—and, in turn, influence prices?

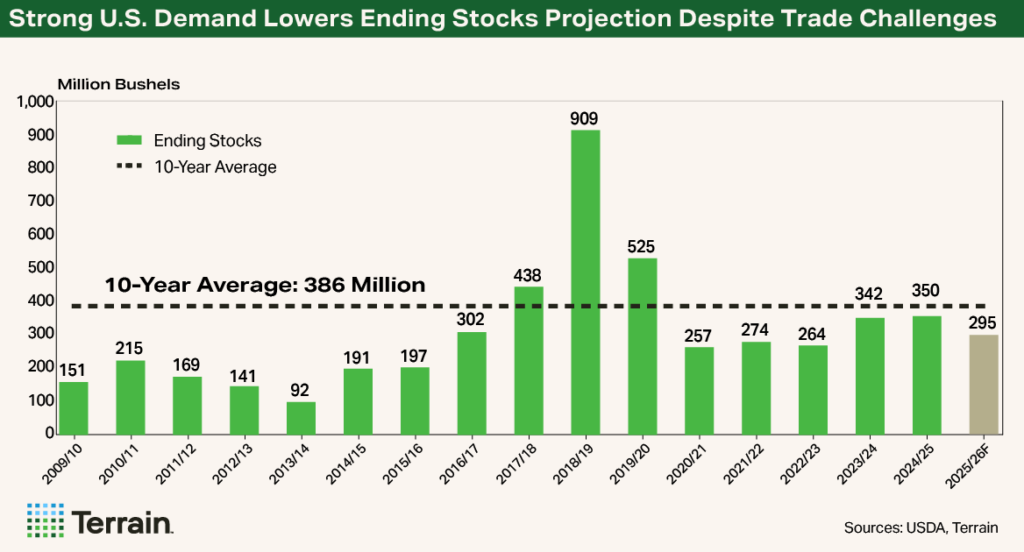

Currently, new-crop corn and soybean stocks-to-use ratios stand at 11.6% and 6.7%, respectively. For soybeans, ending stocks offer a more precise gauge of inventory tightness, as usage is heavily shaped by international trade flows, policy decisions, and global demand shifts. Ending stocks for new-crop soybeans are projected at 295 million bushels—roughly in line with the five-year average but 24% below the ten-year average. From a historical lens, the domestic soybean balance sheet remains tight, though it aligns closely with recent market norms.

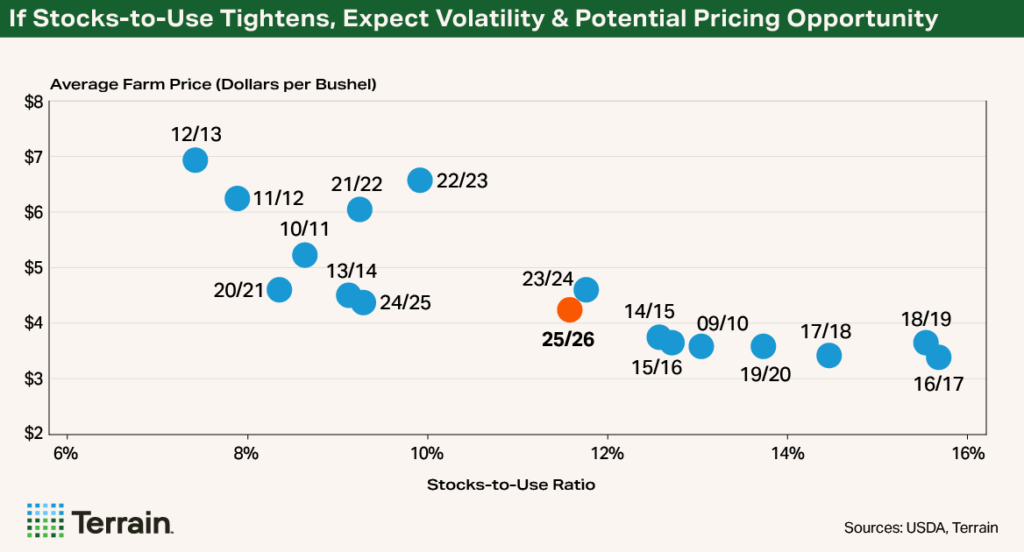

In the corn market, significant upside price volatility historically has occurred when the stocks-to-use ratio dips below 10%. However, the magnitude of this volatility also depends on other critical factors, including global supply and demand trends, ethanol demand, competing feed substitutes (wheat and sorghum) and government policy decisions.

From the perspective of a country seeking to purchase corn in bulk, it’s essential to consider the major global exporters. For the 2025/26 marketing year, Argentina, Brazil, Ukraine and the United States collectively are expected by USDA to account for 88% of global corn exports—above the 10-year average of 85%.

Currently, corn stock levels in Brazil, Argentina and Ukraine are particularly tight. Excluding the United States, the combined stocks-to-use ratio for these three countries is projected by USDA at just 2.7%—a level that, if realized, would be the lowest since the 1983/84 marketing year.

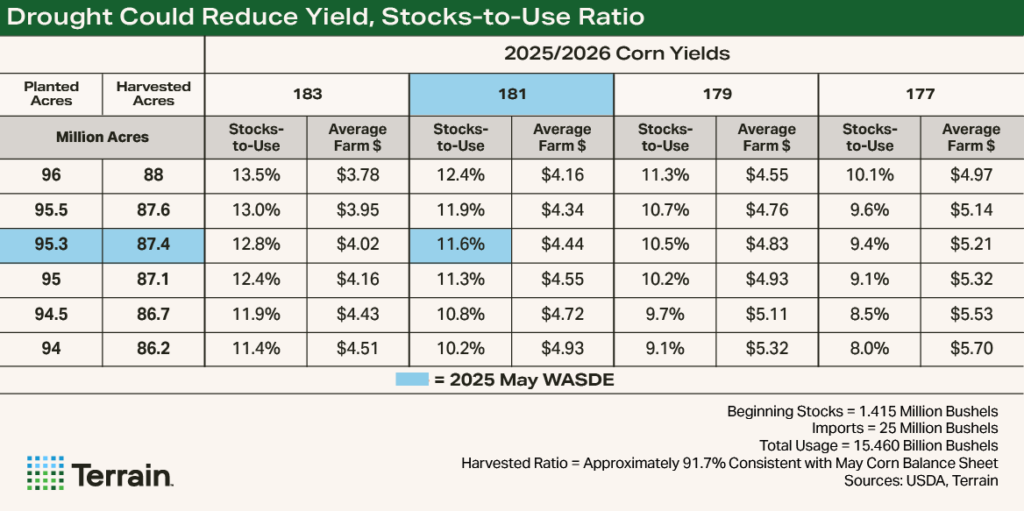

Under these conditions, U.S. corn supplies will play a critical role in meeting both domestic needs and rising global demand. The USDA projects total U.S. corn usage to increase 1.4% from the 2024/25 marketing year to 2025/26, reaching a record 15.46 billion bushels. Assuming all other balance sheet components remain unchanged, a yield decline of just three bushels per acre—to 178 bushels per acre—would be enough to push the U.S. stocks-to-use ratio down to 10%.

With current forecasts calling for hot and dry conditions across much of the western Corn Belt during June, July and August, such a yield reduction is well within the realm of possibility.

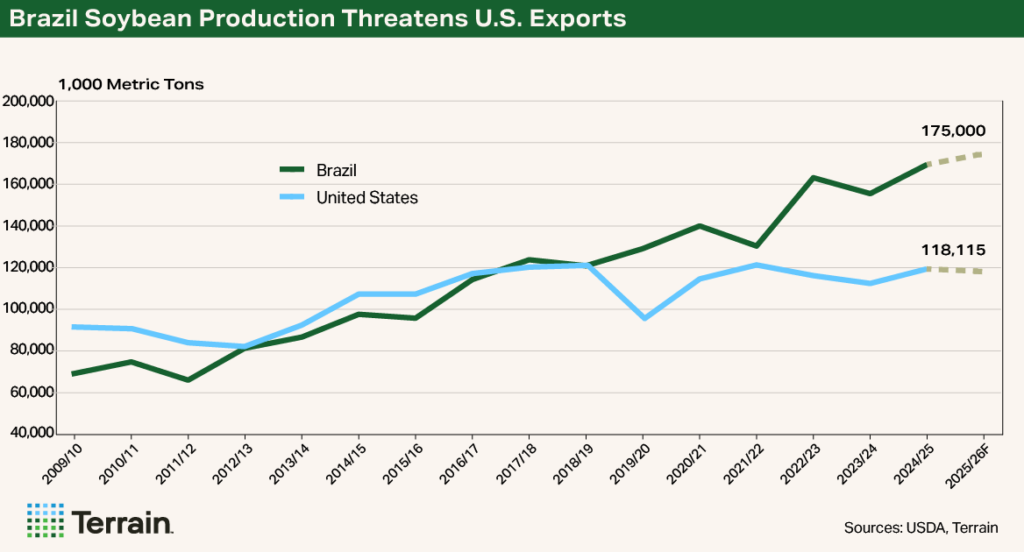

On the soybean front, Brazil poses the greatest competitive threat to U.S. exports due to its cost advantages, production scale, growing global market influence and more attractive currency exchange rate for buyers.

The USDA projects Brazil’s harvested soybean area will expand by nearly 3% from 2024/25 to 2025/26, resulting in a 6-million-metric-ton increase on top of its already record-high 2024/25 production. A weaker Brazilian real relative to the U.S. dollar enhances Brazil’s price competitiveness, while its ability to double crop—planting soybeans followed by corn—and its status as China’s preferred supplier continue to erode U.S. market share and exert downward pressure on prices.

However, the 2025/26 U.S. soybean balance sheet shows a projected increase in domestic crush demand, signaling a growing need for U.S. soybeans despite intensifying international competition.

Terrain’s Price Sensitivity Scenarios

For corn, the range of 94 million to 96 million planted acres reflects market expectations leading up to the 2025 Prospective Plantings report. While the USDA ultimately reported 95.3 million acres, pre-report estimates ranged from an average of 94.2 million acres to a high of 96.6 million.

The 2025/26 corn balance sheet from the May WASDE shows a stocks-to-use ratio of 11.6% at 181 bu./ac. yield and an average farm price of $4.20 per bushel. However, based on the historical relationship between the U.S. corn stocks-to-use ratio and average farm price, we see the potential for the corn market to have a modest price upside to approximately $4.44 per bushel, assuming all other factors remain constant.

At the lower end of the corn acreage range—94 million acres—a trendline yield of 181 bushels per acre would bring the stocks-to-use ratio close to the critical 10% threshold, assuming all other balance sheet factors remain constant from the May WASDE. Based on historical relationships between the U.S. corn stocks-to-use ratio and average farm prices, this scenario would likely place upward pressure on prices, potentially pushing the average farm price into the $4.90 to $5.00 per bushel range.

Conversely, even a modest increase in planted acreage—up to 96 million acres—would only require a four-bushel-per-acre reduction from the 181-bushel trendline yield to maintain a supply-demand balance similar to the lower-end projection.

Soybean market fundamentals may face significant volatility this summer, as the 90-day U.S.–China tariff agreement is set to expire in August—coinciding with the critical pod development stage for soybeans.

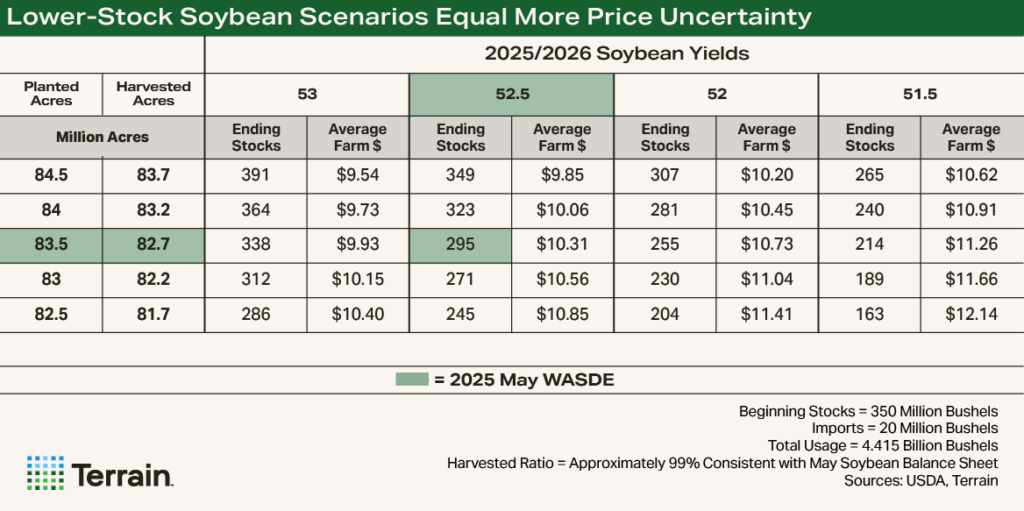

Ending stocks are projected at 295 million bushels, slightly below the five-year average of 297 million bushels, setting the 2025/26 marketing year off to a relatively tight start. This tightening is further compounded by a reduction in planted acreage, which has declined from 87.1 million acres last year to 83.5 million acres this year.

Over the past 18 years, soybean price variability increases as the stock level drops. There’s a noticeable increase in the range of historical prices once the stocks-to-use ratio drops below 8%. Historically, this sub-8% range has seen average farm prices vary by up to $5 per bushel.

When considering the stock level scenarios assessed here, it is important to remember that there is more price uncertainty, or a wider range of possible prices, in those lower-stock scenarios than in the higher-stock scenarios.

As illustrated in the table, even a modest 0.5-bushel-per-acre decrease in yield for 2025/26 would reduce ending stocks by 40 million bushels—potentially bringing them to their lowest level since the 2015/16 season. Even if U.S. soybean exports were to fall to levels seen during the 2018/19 trade war with China—a 73-million-bushel reduction from the May 2025/26 balance sheet—the impact would be roughly equivalent to a one-bushel-per-acre drop in yield, from 52.5 to 51.5 bushels per acre.

This underscores the sensitivity of the soybean balance sheet: any decline in yield or acreage, or a shift in demand—particularly from China—could significantly affect the market.

While these figures suggest Brazil could theoretically meet China’s import needs alone, this is highly unlikely due to the year-round nature of Chinese demand.

Consider the numbers for China. In 2025/26, China is projected to consume 133 million metric tons of soybeans while producing only 21 million metric tons, leaving an import requirement of 112 million metric tons. Meanwhile, Brazil is expected to produce 175 million metric tons and consume 62.3 million domestically, leaving 112.7 million metric tons available for export.

While these figures suggest Brazil could theoretically meet China’s import needs alone, this is highly unlikely due to the year-round nature of Chinese demand. Although Brazil may continue to gain market share, the times of year when U.S. soybeans are priced better than Brazil’s leave room for continued U.S. participation in global soybean trade. Any additional positive developments in trade negotiations between the U.S. and China could further bolster export sales activity, which would be supportive of higher prices.

Keep Eye on Usage in Your Flexible Risk Management Plans

While global and trade uncertainties remain critical factors, the underlying supply and demand fundamentals for corn and soybeans continue to show resilience. In this environment, evaluating different yield and acreage scenarios becomes essential for farmers. Doing so enables more informed, risk-aware decision-making in a highly volatile and uncertain market.

If usage remains strong—as projected in the May WASDE report—it wouldn’t take much for domestic balance sheets to tighten further. Conversely, if demand weakens due to global economic headwinds, trade disruptions or currency fluctuations, stocks could build, placing downward pressure on prices. Additionally, increased competition from South American production and shifts in domestic consumption patterns will continue to influence the outlook.

With acreage and yield projections still in flux given weather variability, total usage remains a critical variable in determining market equilibrium and shaping effective risk management strategies.

Risk management will be especially important for agricultural producers in 2025. The year ahead is expected to bring continued volatility, making it essential for producers to stay informed and adaptable. Marketing plans should be regularly updated in response to shifting market conditions, seasonal trends, weather developments and global events. Flexibility will be key to navigating the uncertainty.

One effective approach is to spread sales throughout the marketing year, use options to maintain pricing flexibility, and diversify or combine marketing strategies to help mitigate downside risk. A tailored risk management strategy is essential—there is no one-size-fits-all solution, particularly in today’s volatile environment. Producers should evaluate whether hedging and rolling strategies align with their operational goals, especially given heightened global uncertainty, evolving supply-demand dynamics, and potential price swings. The goal: protect downside price risk while preserving upside opportunity.

Terrain™ content is an exclusive offering of AgCountry Farm Credit Services, Farm Credit Services of America, Frontier Farm Credit, and American AgCredit.

While the information contained in this site is accurate to the best of our knowledge, it is presented “as is,” with no guarantee of completeness, accuracy, or timeliness, and without warranty of any kind, express or implied. None of the contents on this site should be considered to constitute investment, legal, accounting, tax, or other advice of any kind. In no event will Terrain or its affiliated Associations and their respective agents and employees be liable to you or anyone else for any decision made or action taken in reliance on the information in this site.