Farm Credit Services of America (FCSAmerica) and Frontier Farm Credit are co-sponsoring a webinar series, Two Economists and a Lender. This December installment, featured Agriculture Economic Insights (AEI) co-founders David Widmar and Brent Gloy and Chad Gent, our senior vice president of credit, reviewed the top lessons from 2019.

Below are highlights from their discussion, as well as the full webinar.

This was a challenging year for many, with a late-winter storm that caused calf losses and, subsequently, poor conception rates, followed by the extremely wet spring and flooding.

But before saying “good riddance” to 2019, it is worth considering what knowledge can be carried forward to the new year, economists David Widmar and Brent Gloy believe.

- The market was reluctant to respond to weather events as a result of existing large supplies. Using a 10-year average of December corn futures closes, a seasonal rally usually begins in April and prices remain comparatively advantageous through summer.

This year, prices slid lower through May and the seasonal rally didn’t really kick in until late May, when December futures jumped sharply higher. “You could price corn above $4.20 for 58 days,” Gloy said, referring to summer prices (see lines on chart). “It was over $4.40 for quite a number of those days and above $4.50 several days. So there was plenty of opportunity.”

Review your marketing and how it aligned with pricing opportunities in the past year. “If you are like me, odds are you will conclude you should have done more,” Gloy said. “It is not a good thing when prices are heading higher and your sales amounts are trending lower.”

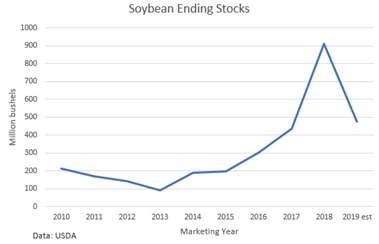

- The past year highlighted the need to consider the base starting point when looking at market prospects. Soybean ending stocks estimates fell 50%. “But it was from such a lofty level that they are still above average – and the market reflects that,” Gloy said (see graph).

- Write down your good marketing decisions, as well as what went wrong. “Our work with producers has demonstrated that the successful ones keep an eye on their breakevens and consistently sell when the market offers a profit,” said Chad Gent, senior vice president of credit, who joined the two economists on this webinar. “Marketing is definitely a differentiator.”

- Look at your whole picture. USDA reports farm income will be up this year – but keep in mind the Market Facilitation Program is a big contributor. “Working capital is down and total debt is up,” Widmar pointed out. “That means the income is not covering all costs.”

- If your operation is experiencing a financial squeeze, sort out the symptoms, causes and solutions. “If it is a short-term situation caused by lost production, restructuring or refinancing may loosen up some cash so you can ride it out,” Gent said. “But if your operation is not cash-flowing, perhaps due to a high cost structure, changing the term of your debt won’t fix it.You need to fix the root cause.”

This gets back to knowing your cost of production – and not overlooking expenses such as family living and labor, he said.

“Based on USDA data, $94 out of every $100 of farm income goes to cover debt and expenses. But that is not net of all costs; it does not include depreciation or family expenses.

- Dig deep into risk management choices. “Twenty-nineteen exposed chinks in our armor,” said Widmar. It is worth asking about the adequacy of Prevent Plant coverage, flood protection, vulnerability of stored grain and not just potential for lost cattle in storms, but also impacts on breeding back.”

“Farm Credit Services of America crop insurance officers have a new, robust tool to help determine the optimal level of insurance and farm bill choices,” Gent offered.

Summary

Heading into 2020, it may feel like déjà vu, Gloy summed up. Some of the same uncertainties felt in early 2019, such as weather and trade, remain. The election is a new potential disruptor. But keep in mind, ending stocks are in a somewhat better situation and hope remains that trade deals will be inked and live up to their promise.