Farm Credit Services of America (FCSAmerica) and Frontier Farm Credit sponsored a webinar, “MFP 2019: From D.C. Policy to Farm Budgets,” featuring Agriculture Economic Insights co-founders Brent Gloy and David Widmar. Highlights from MFP webinar are below along with the full webinar recording.

How should you view your MFP payments?

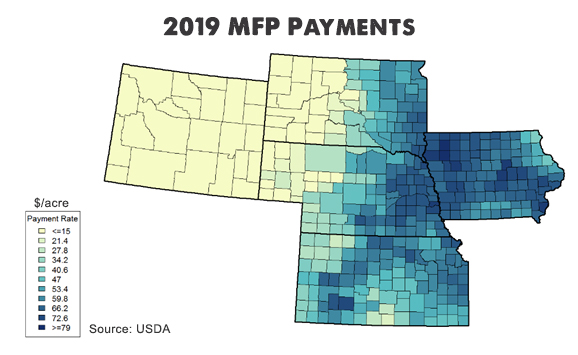

Direct farm payments in 2019 could constitute one-fourth of net farm income, the highest proportion in a dozen years. The Market Facilitation Program (MFP) implemented to offset the impact of trade disputes to U.S. agriculture will provide more than $50 per acre in income to producers in parts of our territory (see map).

A webinar hosted by Farm Credit Services of America and Frontier Farm Credit helps producers better understand the impact of this year’s direct payments – for both their operations and the industry as a whole. Presenters David Widmar and Brent Gloy, co-founders of Agricultural Economic Insights (aei), as well as Derek Mohr, a financial officer based in Perry, Iowa, spoke just hours after USDA announced details about the issuance of MFP payments.

The first payment, expected this summer, will be up to half the announced rate for a producer’s county. Payments can range from $15/acre to $150/acre. There is no guarantee rounds two and three will occur.

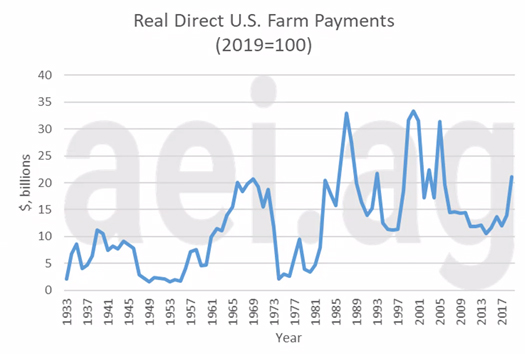

The $14.5 billion earmarked for MFP payments is big, but no record. Direct payments were higher in inflation-adjusted dollars in each of several years between 1985 and 2005, the economists noted.

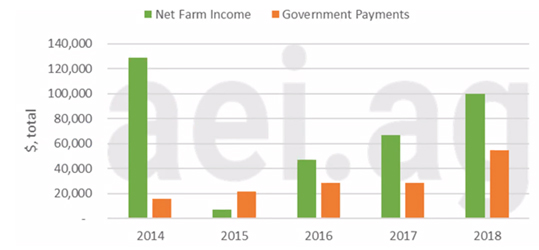

Government payments issued in 2018 proved significant for grain-producing states. Overall net farm income for members of the Kansas Farm Management Association increased from 2017 to 2018, with 80 percent of the increase attributed to direct government payments (including MFP, ARC/PLC, disaster payments and conservation payments).

Gloy and Mohr advised producers to be strategic about how 2019 government payments fit into their financial planning.

“When MFP payments were announced last year, we counseled our customers to retain as much as they are able and use the money to replenish working capital. Liquidity is essential in this ag environment. We are recommending the same this year, especially for those who end up having a good year.”

– Derek Mohr, financial officer based in Perry, Iowa

He noted that crops in his area are looking good – and market volatility offered better-than-expected prices for corn and soybean.

“It is risky to make any plans based on government programs,” Gloy said. “I would not make tax or purchasing decisions driven by this income, for instance,” he said.