Cattlemen are experiencing both long- and short-term effects of the transition to more beef production.

“The feedlot business has really seen a boom–bust move over the past few years,” said Jay Wolf of Wagonhammer Cattle Company, part of a diversified Nebraska ranching business that has been family owned for more than 100 years. “At our Albion feedlot, we often own animals for more than 12 months. We thought that sometime during that period we’d see an opportunity to at least lock in breakeven but that has not occurred.”

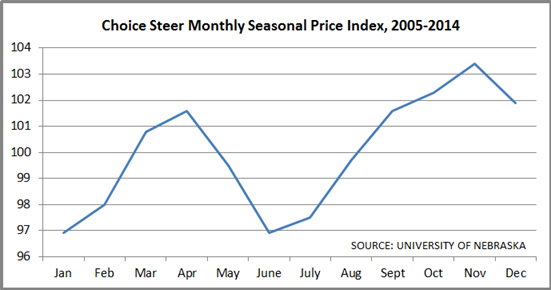

Looking at the most recent move, June fed cattle prices, which had traded in the $132/cwt. area in mid-March, fell to $114 in late April before more recently improving to $122 to $124. Negative price action in April took many by surprise since it came during a month when prices usually trend higher, before dropping to summer lows (see seasonal price chart).

The reason: Slaughter picked up before grilling season demand was able to do so. The last two weeks of April saw steer/heifer slaughter near 590,000 head/week – more than any other week since August 2013 – and the month’s total was 6 percent over a year earlier. Analysts had expected numbers to be flat or lower compared with last year. A fairly large kill is expected to continue through May.

Packers had seen their bottom line move into the black and encouraged pulling sales forward to take advantage of April futures being sharply discounted to cash prices. That now has reversed because they were forced to discount boxed beef prices to move product.

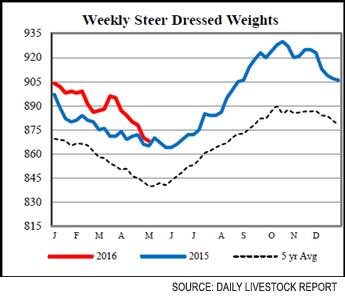

The good news is the industry now is current. As the USDA’s May 12 data in the chart below show, weights now have fallen to 2015 levels. Given the seasonal pattern, it’s likely they’ll begin heading higher again in the next few weeks.

Retailers are well stocked and should have enough beef to run features through May, fueling up grills as Memorial Day approaches, albeit six days later than last year.

Retailers are well stocked and should have enough beef to run features through May, fueling up grills as Memorial Day approaches, albeit six days later than last year.

“The big question for the short-term now is whether beef demand will be sustained after the holiday,” says Steve Meyer, coauthor of The Daily Livestock Report.

With recent high numbers moving, fed-cattle supplies are projected to slide lower into July. In this month’s Cattle on Feed report, cattle on feed 150 days or more are projected to be 14 percent below last year, according to Steve Kay of Cattle Buyers Weekly. CattleFax estimates a reduction of just 1 percent. This could lead to contra-seasonal price strength during June (see seasonal price chart), some analysts believe.

In addition, beef supplies in cold storage are being drawn down: In its April report, USDA reported inventories dropped 5 percent from the prior month and were down 10 percent from two months earlier. Compared with a year ago, there was 3 percent less on hand at the end of March than a year ago and a half percent less than the five-year average. Lower imports are helping reduce available supplies.

Demand side

Not only are we entering a seasonally stronger time frame for beef, but exports are showing signs of improvement as well – especially in Asian markets such as South Korea and Taiwan, where volume in the first quarter jumped 25 percent and 20 percent above the same time last year. Our long-term top market, Japan, boosted purchases by a more modest 9 percent from a year ago. First-quarter exports to Canada fell 9 percent and to Mexico, 14 percent, mainly due to exchange rates.

“Exports are critical to beef producers,” said Wolf, “And the last year or so was frustrating, both because of the strong dollar and the fact that Australia was able to negotiate lower tariffs in Asia, putting the United States at a disadvantage. It is encouraging to see some improvement in 2016, but the beef industry really would like to see the Trans-Pacific Partnership signed into law.”

What’s Next

The earlier-than-expected downturn created some potential for producers to lock in breakeven or even a small profit on the next turn of cattle, noted Adam Wacker, Farm Credit Services of America (FCSAmerica) vice president, credit – beef industry.

“By at least one profit estimate, cattle put on feed in the second week of May had a projected breakeven of about $116/cwt. and the futures price for when they leave the feedyard in mid-May was about $118/cwt., implying some profit potential, subject to basis at the time of sale.

Click to read Part two in the series on Cattle Transition: Cow/Calf Caution.

Also of interest: Cattle Market Emerging from Uncharted Territory