Pork producers are no strangers to the cyclical swings of the marketplace. So perhaps it shouldn’t be surprising that they are philosophical about the current change in fortune — even if the downward slope is steeper than usual.

“We’re focused on the key factors for success in any down cycle,” says Bruce Livingston, president and owner of Livingston Enterprises Inc., a 24,000-sow breed-to-wean operation in Fairbury, Neb. that Livingston grew from six gilts at age eight. “We aim to be efficient in controlling our input costs and to take advantage of opportunity when it presents itself. I try to control what I can and not pay as much attention to things I can’t. Attention to detail in sow operation is a top priority.

“I believe in taking the singles, not trying to hit home runs.”

Following that approach, Livingston had almost three quarters of his production contracted prior to the big price run-up in 2014 caused by the PEDv outbreak. It also meant he had contracts in place when the market plunged last October.

“You can’t go broke making a profit,” Livingston says. “If the profit is there, options strategies are available to protect the downside but allow upside potential.”

At least 95 percent of Agribusiness Finance customers at Farm Credit Services of America (FCSAmerica) use hedging, for inputs and for sales, says Ron Durre, vice president of agribusiness lending. Large-scale hog producers “have become very astute and quite sophisticated in the margin-management strategies,” with some hedging as much as 90 percent of expected sales, Durre says.

During the 2014 boom, the top third to half of hog producers served by FCSAmerica built strong equity and capital on their balance sheets. “Top guys look at these [lower] markets and see them as a blip and simply something to get through,” Durre says.

Pork Supplies Up

Livingston figures with the number of pigs coming this year, the market is unlikely to turn, unless there’s an unforeseen circumstance such as disease or a surge in exports.

Although pork production is expected to rise only by about 1 percent in 2016, that follows an 8 percent increase last year, when 115,391,900 head were slaughtered – second only to 2008. At the same time, beef production is projected to rise 4 percent and poultry, 3 percent.

New slaughter demand from two 10,000 head/day plants being built – one near Sioux City, Iowa, the other in Coldwater, Mich. – have producers in those areas looking at permanent expansion mode.

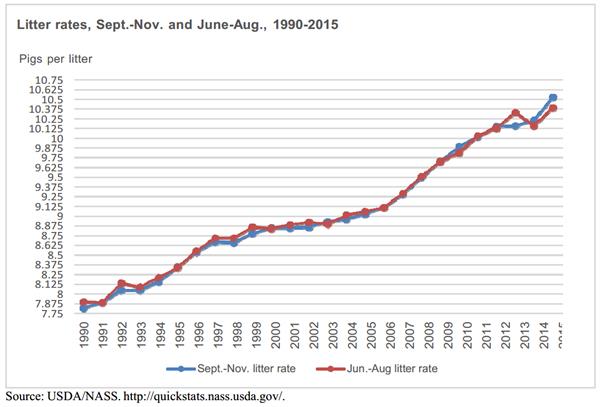

However, cyclical production already may be slowing as producers anticipate worsening margins. After the 2014 setback caused by PEDv, efficiency rebounded and set new records in both June-August and September-November 2015.

Winter farrowings are projected to be down 2 percent and summer farrowings, unchanged from last year. Farrowings in the first half of 2016 will be down 1 percent from last year but that is likely to be more than offset by strong litter rates and slightly higher hog weights, USDA economists believe.

On the demand side, the strong dollar is playing havoc with trade: While exports rebounded in 2015, almost reaching 2013 levels, imports increased supplies by an additional 2 percent, according to some estimates.

“Trade is a big deal for pork markets,” Durre says, noting that a quarter of production is exported.

Traders have been disappointed with the pace of Chinese pork purchases. USDA projects exports this year to increase about 4 percent, from 4.946 billion pounds to 5.125 billion, while imports will be close to even, easing from 1.106 billion to 1.0 billion.

In addition, pork in cold storage has been setting records. USDA’s Jan. 1 cold storage report indicates pork in freezers is up 8 percent; pork bellies, 13 percent; and beef, 16 percent. Total red meat supplies in freezers were 12 percent above last year.

Bottom line: With 2016 meat and poultry supply pegged almost 5.3 billion pounds over just two years ago, there will be plenty of protein available and retail prices are likely to drop to encourage consumption. For more on this, read the Cattle Market Emerging from Uncharted Territory blog post.

In January, USDA forecast lean hog prices will average $46 to $49 in 2016, down more than 5 percent from $50.23 last year. On a quarterly basis, USDA price projections are: January to March, $44 to $46; April to June and July to September, $50 to $54; October to December, $39 to $43.

Summing up the situation in early 2016, Durre says: “While there is near-term uncertainty about margins, most producers are still cautiously optimistic about the long term.”