It’s not what you earn, it’s what you spend. For farm families whose living expenses crept up during the recent run of strong commodity prices, Dr. David Kohl’s words serve as a call to action.

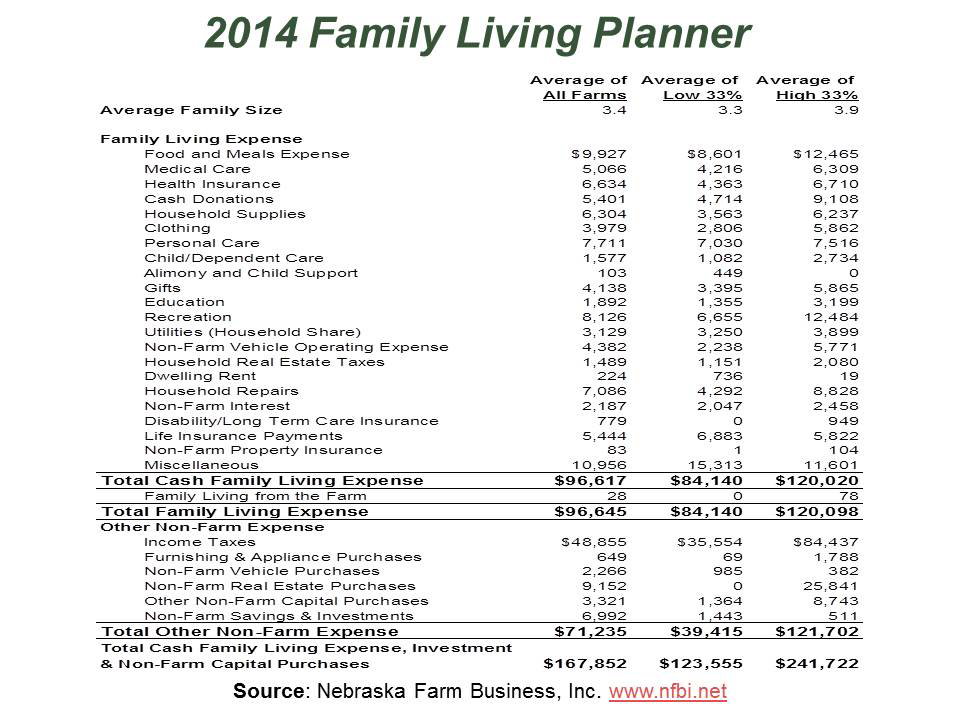

Dr. Kohl repeated the phrase throughout this year’s Side By Side Conference, our annual three-day event for young and beginning producers. Left unchecked, Dr. Kohl cautioned, family living expenses threaten the profitability of farm operations. Top managers are adjusting family living and other costs to ensure they aren’t on the wrong side of agriculture’s widening gap in profitability.

Below are key strategies that Dr. Kohl recommended for taking control of family living expenses:

- Follow the 60-30-10 rule: Sixty percent of farm profits are invested in improved efficiency; 30 percent goes to a working capital reserve to build liquidity; 10 percent is earmarked for discretionary spending, or family living.

Families desiring a higher standard of living might need non-farm income to supplement their withdrawals, he says. But he has advised withdrawing less if families are operating their farms with a debt-to-asset ratio (total farm liabilities divided by total farm assets multiplied by 100) of more than 50 percent.

- Separate business and personal expenses. Dr. Kohl advises developing a family budget that breaks down costs on a monthly basis. Set aside the budgeted amount, plus 25 percent for unexpected costs.Then stick to the budget.

Our financial officers work with customers to better track living expenses so families are in a better position to set spending goals that are right for them. Contact your local FCSAmerica financial officer if you’d like help assessing how family living expenses affect your farm operation.