The overall trend of weakening cropland prices continued through 2016 in the grain belt states served by Farm Credit Services of America (FCSAmerica) and Frontier Farm Credit. However, the pace of decline remains slower than expected.

The large 2016 corn and soybean crops through much of the region helped profitably levels and contributed to continued demand for quality tracts, said Mark Jensen, chief risk officer for FCSAmerica and Frontier Farm Credit.

“That being said, overall margins remain tight and input costs still are adjusting downward,” Jensen said. “As a result, we anticipate continued pressure on real estate values.”

FCSAmerica and Frontier Farm Credit track all farmland sales in Iowa, eastern Kansas, Nebraska, South Dakota and Wyoming. Appraisal teams also update values on 71 benchmark farms every January 1 and July 1. The resulting data is the largest and most comprehensive snapshot of farmland values in the region.

Below are state-by-state trends based on land sales completed through Dec. 31, 2016:

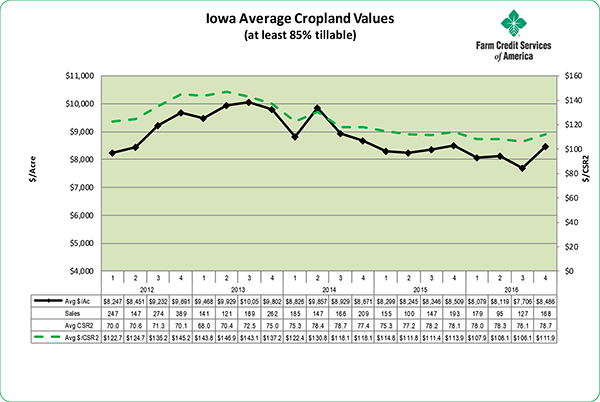

While values on Iowa farmland had been dropping at a faster rate than in other states served by FCSAmerica and Frontier Farm Credit, the market stabilized somewhat in 2016, particularly in the last half of the year. The average 2016 price for an acre of Iowa farmland -- $8,123 – was 2.8 percent lower than in 2015 -- $8,370. Since the market’s peak in 2013, the average sale price is down 17.3 percent.

Public auctions dropped 3 percent in 2016 and completed sales were down 7 percent compared to 2015.

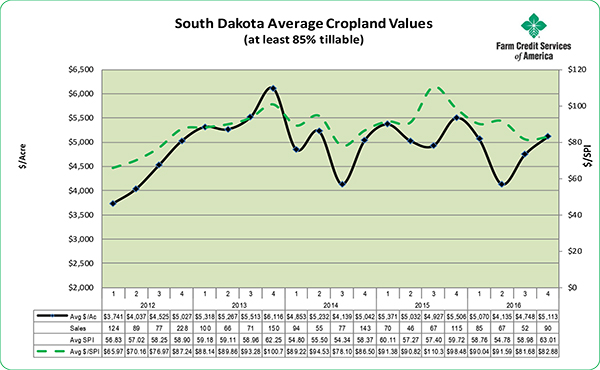

In South Dakota, farmland prices gained ground in 2015 only to drop 8.6 percent in 2016 to $4,813 per acre. Since 2013, the average price of South Dakota farmland is off 14.8 percent.

The number of public auctions was similar to 2015. Total sales declined 8 percent.

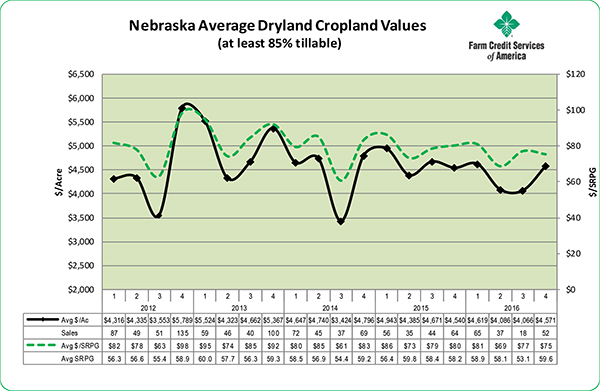

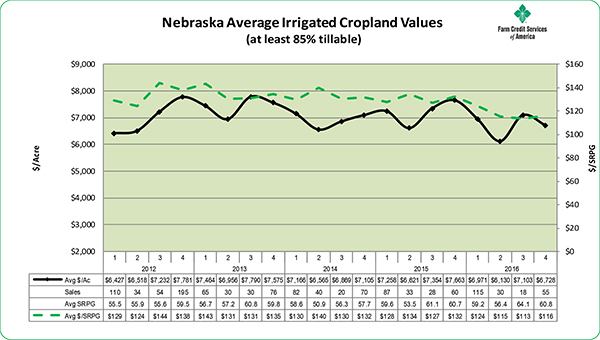

Nebraska’s average 2016 sale price for dryland -- $4,432 per acre – was down nearly 4.8 percent from the previous year and 13 percent since 2013. The average 2016 price for irrigated Nebraska farmland -- $6,805 per acre -- was 6.6 percent lower than in the previous year and 9 percent lower than in 2013.

Public auctions were down 14 percent from 2015 and sales declined 18 percent.

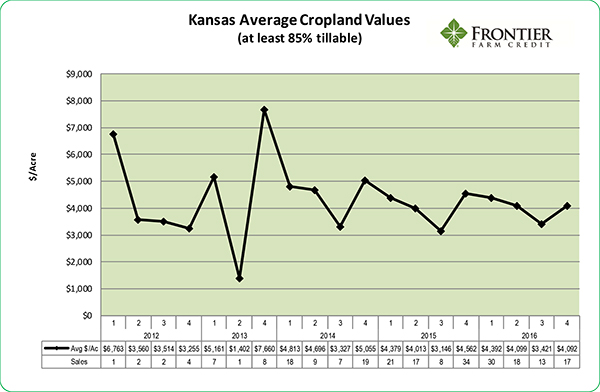

In eastern Kansas, farmland sold for 3.7 percent less in 2016 than in 2015 -- $4,097 vs. $4,256 per acre. Prices are down 12.5 percent since 2014, when the associations began tracking farmland sales in the state.

Completed sales were down 12 percent compared to 2015.

Wyoming had too few sales to identify trends. The number of completed sales in Wyoming was 45 percent lower than in 2015.

The following table tracks changes in appraised values of the associations’ benchmark farms, beginning with the final six months of 2016:

|

State

|

Six Month

|

One Year

|

Five Year

|

Ten Year

|

|

Iowa (21)

|

-0.8%

|

-4.7%

|

3.4%

|

119.3%

|

|

Kansas (7)

|

0.1%

|

-1.9%

|

|

|

|

Nebraska (18)

|

-3.3%

|

-7.6%

|

28.1%

|

184.5%

|

|

South Dakota (23)

|

-3.2%

|

-6.8%

|

57.5%

|

184.3%

|

|

Wyoming (2)

|

0.0%

|

7.8%

|

35.8%

|

62.7%

|