After a nice seasonal price run-up between mid-May and mid-June, August futures (see bar chart) followed their seasonal tendency to drop into the fall.

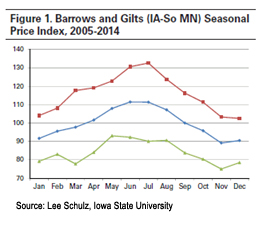

The seasonal chart from Iowa State University illustrates that pattern. Note that 100 on the scale represents the 10-year average price. The blue line by comparison represents an index for the 10-year average monthly price. For instance, the June index (blue line) is just 10 percent above the average, while the fall lows are about 10 percent below the annual price. The red and green lines represent one standard deviation – the upper and lower limits that would include two-thirds of the years. Notice that June has the most variability, while the fall lows are more reliable.

The seasonal chart from Iowa State University illustrates that pattern. Note that 100 on the scale represents the 10-year average price. The blue line by comparison represents an index for the 10-year average monthly price. For instance, the June index (blue line) is just 10 percent above the average, while the fall lows are about 10 percent below the annual price. The red and green lines represent one standard deviation – the upper and lower limits that would include two-thirds of the years. Notice that June has the most variability, while the fall lows are more reliable.

This year, packing capacity – particularly in the Midwest – is expected to be very tight from December through March, said Bob Timm, retail commercial lender at Farm Credit Services of America (FCSAmerica), who is just back from the World Pork Expo.

“We may see a situation similar to last fall in the beef market, when packers weren’t able to handle the numbers and weights increased as a result.”

Contracting sales in advance may be an answer on existing production capacity, Timm said. But it’s unclear whether plants will extend contracts to include new pigs as producers ramp up.

“Some of the expansion taking place is in anticipation of new slaughter facilities that will open their doors in the second half of the year. Those producers who expand will just have to make it through until the plants open.”

Two large plants are coming in the Midwest with plans to handle 10,000 head a day on the basis of a single shift. Seaboard Triumph Foods at Sioux City, Iowa, and Clemens Food Group at Coldwater, Mich., are scheduled to open next year and will boost national capacity by nearly 5 percent.

Prestage Farms is looking for a site in Iowa to open in 2018. Smaller plants in Missouri and southern Minnesota have been renovated and will reopen fairly soon, according to Jeff Wiepen, FCSAmerica vice president and agribusiness lender.

Some analysts, such as Steve Meyer, economist with EMI Analytics in Ft. Wayne, Ind., worry that the expanding slaughter capacity could eventually lead to closures of some smaller, less efficient plants.

Record hog inventory brings pressure

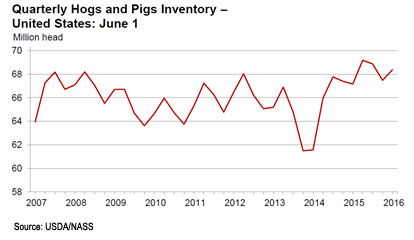

The June 1 hogs and pigs inventory, at 68.4 million head, is the largest June number since USDA began its estimates in 1964. It is 2 percent above the same time last year and is above expectations.

The June market hog inventory, at 62.4 million head, also is up 2 percent from last year and the highest since 1964. The breeding inventory, at 5.98 million head, is up 1 percent from last year. The March-May pig crop came in at 30.0 million, 3 percent above last year and the largest since 1971. Productivity is also higher, with pigs saved per sow at 10.48, up from 10.37 in 2015. All of this points toward ample supplies over the next six months, which will put pressure on packer capacity.

The June market hog inventory, at 62.4 million head, also is up 2 percent from last year and the highest since 1964. The breeding inventory, at 5.98 million head, is up 1 percent from last year. The March-May pig crop came in at 30.0 million, 3 percent above last year and the largest since 1971. Productivity is also higher, with pigs saved per sow at 10.48, up from 10.37 in 2015. All of this points toward ample supplies over the next six months, which will put pressure on packer capacity.

Demand side

To avoid a glut of pork in the U.S. market, the dollar needs to weaken, not strengthen as it has in the wake of Britain’s vote to exit the European Union.

“Between 20 and 25 percent of production is currently exported and domestic demand is fairly static, thus we will be more heavily reliant on exports if we are to avoid heavier supplies weighing down the domestic market,” Wiepen said. Which is why “the Trans-Pacific Partnership agreement is a big issue for the pork industry. Pork would be a big beneficiary.”

Despite the challenges that come with a growing herd and increased supplies, FCSAmerica anticipates that 2016 will be a decent year for pork producers.

“Most of our customers,” Wiepen said, “have employed solid risk management strategies to navigate the volatility in the markets.”