Think of your farm’s balance sheet as a check-up on the health of your operation. Each year, it provides a point-in-time snapshot of your net worth: How is your operation doing financially? From one year to the next, it reveals trends, both good and bad: How are things progressing, where are my challenges? Used effectively, your balance sheet addresses the long-term viability of your operation.

A balance sheet is quite straight-forward: Current and noncurrent assets are listed on one side, current and noncurrent liabilities on the other side. The difference in the totals is an operation’s equity, or the operation’s solvency.

Most businesses update their balance sheet at the end of the accounting period, such as the end of the tax year. Some check their numbers quarterly. For grain operators, post-harvest is a good time to update balance sheets because the information will be more accurate and provide more value. The best time for cow-calf operations is when calves are on the ground.

But in the end, says Kevin Hicks, a credit operations analyst at Farm Credit Services of America (FCSAmerica), “since that balance sheet is a reflection of your operation, take that balance sheet at a time that is good for you.”

Then update your balance sheet at the same time every year. “The balance sheet is kind of like the scoreboard in agriculture,” says Nick Bauer, a financial officer. “The results of that balance sheet from one year to the next is telling you: Are you winning or do you need to make some adjustments heading into the next year?”

If you would like to learn more about balance sheets, watch a video recording from our Balance Sheet Best Practices webinar. For more educational opportunities, visit the Webinars and Side by Side Digital series pages to register for an upcoming webinar and watch previously recorded websinars.

Assets

Let’s look first at the asset side of the balance sheet. Assets are everything owned by a business or individual. Current assets are considered “liquid”—those that are cash or can be turned into cash promptly, including checking and savings accounts or mutual funds, stored production (such as grain in the bin), market livestock and growing crops, feed on hand, paid-for but not yet used inputs or other supplies, and accounts receivable.

Noncurrent assets are those that can’t be readily sold, such as machinery and equipment, vehicles, breeding livestock, co-op stock, farmland, your house, other buildings, or a retirement account that is subject to government withdrawal penalties, etc.

Liabilities

Current liabilities are those that are due right away—usually within the next 12 months. These include accounts payable (such as for inputs, or land rent), farm taxes, current notes and credit lines, accrued interest on operating or term loans, the current portion of principal due in 12 months, credit card debt or loan payments to family members.

Noncurrent liabilities include loans used to purchase assets that have a life-span of more than a year, such as vehicles, machinery, farm ground or a home. They also could include an agreement to buy out a partner or a parent’s share of the business.

Valuation Issues

While the concept of a balance sheet is fairly simple, it is not without gray areas. For instance, how do you value grain in a bin or market livestock? Machinery or equipment? Farmland? Do you use a cost basis or market basis? In some cases, the resulting value can be quite different.

For production of commodities such as grain and livestock, using a market valuation makes sense. The market price might be one that is locked in on a sales contract or a local destination’s delivery price. While the value of unsold inventory changes daily, producers commonly use prices for the date their balance sheet is completed to capture the value of their assets.

Putting a value on vehicles or machinery is more difficult. A piece of machinery that cost $250,000 new will be valued differently at today’s replacement cost or trade-in market value. Depreciation is used by many producers to account for changes in value. Just be sure to depreciate every year to ensure consistency in tracking values and to capture any moves in the market for resale or trade purposes.

The value of farmland and other noncurrent assets also changes over time. Again, consistency is key. If you always carry assets at a cost basis, continue to do so. This will help you avoid any misrepresentation of a balance sheet due to variances to the market over time.

Liabilities are a bit easier: Terms of loans are spelled out and the repayment amount as of a given day, even for credit cards, generally can be accessed online.

An easy check and balance is to match assets to liabilities. Most assets will match up to a liability. For instance, if a growing crop is listed as an asset, check that accounts payable for associated seed, fertilizer and chemical have been included as liabilities.

The Bottom Line

The balance sheet is a tool to identify and determine the strength of your operation or your reserve risk-bearing capacity. If you are consistent in how and when you capture your assets and liabilities, it is easy to see your operation’s financial progression from one year to the next. It also is important to share with your lender your chosen methods for tracking the value of your assets so everyone has a clear understanding of your operation’s financial health.

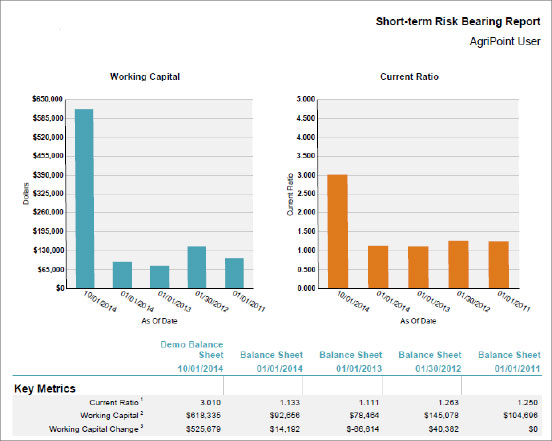

AgriPoint®, one of the free digital tools available to customers of Farm Credit Services of America (FCSAmerica), includes a worksheet with current assets and liabilities, followed by noncurrent assets and liabilities. When you click a category, it provides a drop-down menu of items that fit the category. You can enter what the item is and the amount. As you progress through the form, it automatically calculates your working capital and net worth. When you are finished, you can save your balance sheet for future use, and a click of a button will turn it into a PDF you can file or email, etc.

Create balance sheets, cash flows and examine year-over-year trends in your business.

Uses of the Balance Sheet

Balance sheets are a great tool to evaluate alternative debt structure options that will assist in managing through difficult times. Whether you are creating a balance sheet for your banker or for your own use, here are some measures of your financial position that your balance sheet will provide:

- Solvency measures the relationships among assets, liabilities and equity to assess “health” of your operation.

- Liquidity measures the operation’s ability to meet current financial obligations as they come due without disrupting normal business—the ability to generate cash in the short-term.

- Trends: As you update your balance sheet from year to year, you can see whether your business is progressing—whether equity is growing or shrinking, and whether you are maintaining adequate liquidity.

AgriPoint® includes an option to create trend reports, which show how your operation has been performing historically. The online tool also can run scenarios on how a purchase - or change in price - would affect various aspects of your operation and bottom line.