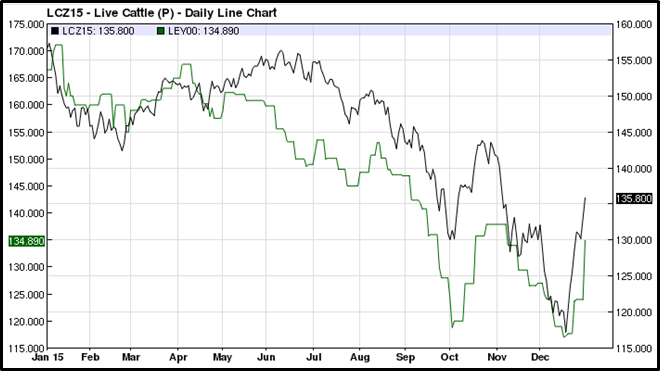

Any way you cut it, cattle producers had a wild ride in 2015 in the face of unprecedented price volatility. For instance, the December futures contract plummeted from a high near $171/cwt. in January to a low near $116. The $55/cwt. loss equates to a drop of $825 on a 1,500-lb. animal. This was the largest decline ever in a single calendar year, both in terms of value and percentage of change, noted Adam Wacker, a beef industry credit officer with Farm Credit Services of America (FCSAmerica). Then, in the final two weeks of the year, the market increased $19/cwt., adding back nearly $300/head.

“That change also is likely one of the largest ever,” Wacker said.

Cash markets, which began the year above December futures, plunged even further (see chart).

Drama taken in stride

Price cycles are a fact of life for cattle producers and this one’s record volatility didn’t keep Case Gabel awake at night. Gabel, president of Herd Co, a commercial feedlot in Bartlett, Neb., and partner in several other cattle businesses, uses a full range of marketing tools, including futures and options, to “eke out a consistent margin on both up and down sides of the cycle.”

“Opportunities for forward hedging are as good today as we’ve seen in several years,” Gabel said near the end of 2015. “The ability to buy and place a feeder today and hedge in a profit on it as it leaves the feedyard – the forward crush margin – has improved substantially.”

Risk management is widely adopted among FCSAmerica customers, according to Jud Jesske, who focuses on beef producers as a FCSAmerica Agribusiness Financing vice president. Benchmarking data indicates that more than 60 percent of FCSAmerica’s ABF beef customers had hedged at least half their cattle on feed heading into 2015, with 41 percent hedging more than 90 percent of their cattle.

Dave Karnopp, retail commercial lender to the beef sector in FCSAmerica’s Norfolk, Neb., office, noted that feeder cattle moved with fed cattle, and those placed at the end of 2015 cost under $150/cwt., compared with $225 for those closing out at that time. As a result, calves bought in much of December “will have some profit potential,” although winter weather always plays a role in pen conditions, death losses and cost of gain, Karnopp said. A tough winter could cost producers “anywhere from 75 cents to $1 a pound,” he said.

Given that feeder prices are 30 percent lower than a year ago, Gabel said it would be a mistake for feedlot managers to panic in the face of lower priced close-outs.

“It’s important to keep a level head,” he said. “I like to say, ‘Be fearful when others are greedy and greedy when others are fearful.’ Inventory management is key: It is not a time to give up inventory. If the cost to feed cattle has dropped 30 percent, I certainly wouldn’t want to feed fewer cattle if I can help it.”

Calmer waters ahead?

The record highs of this cycle, prompted by the extremely tight feeder cattle and fed cattle supplies, likely are history and the cattle cycle is turning to lower prices, probably at least through 2018 or 2019, analysts say.

“We have seen back-to-back perfect storms – first on tight protein supplies, now on ample supplies,” Jesske said. “Heavy cattle weights led to increased production at a time when consumers had turned to competing meats and the strong dollar killed exports.”

Although USDA estimates 2015 beef production was 2 percent lower than in 2014, fed cattle weights near year-end were 25 to 29 lb. heavier than a year ago.

“With each pound equal to an additional 12,000 head nationally, that’s like 300,000 to 350,000 head added to supplies,” Jesske said.

USDA projects 2016 production to be up 3.8 percent from last year, and 1.4 percent over 2014. Just as importantly, production of pork and poultry rose by the most on a year-over-year basis in at least 65 years and is expected to continue to grow. USDA’s January estimate for 2016 shows the supply of all meat and poultry to be up almost 5.3 billion pounds compared with 2014. On a per capita basis, it is up 11.6 lb.

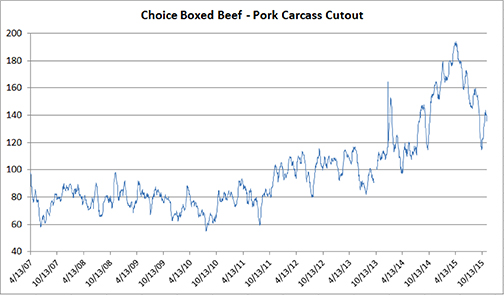

The increasing availability of pork as producers ramped up production post-PEDv led to a record price spread for pork carcass cutout against high-priced wholesale Choice boxed beef, making beef a harder sell at retail, according to Alan Brugler, president of Brugler Marketing and Management in Elkhorn, Neb. (See Chart.) From 2007 through 2010, that spread bounced between $60 and $100/cwt.; in 2011, it shifted up to an $80-$120 range. Then in mid-2014, it began to escalate, reaching a peak above $190/cwt. in early 2015. Since then, it has narrowed back to $120-$140, allowing beef to become somewhat more competitive.

Source: Brugler Marketing and Management

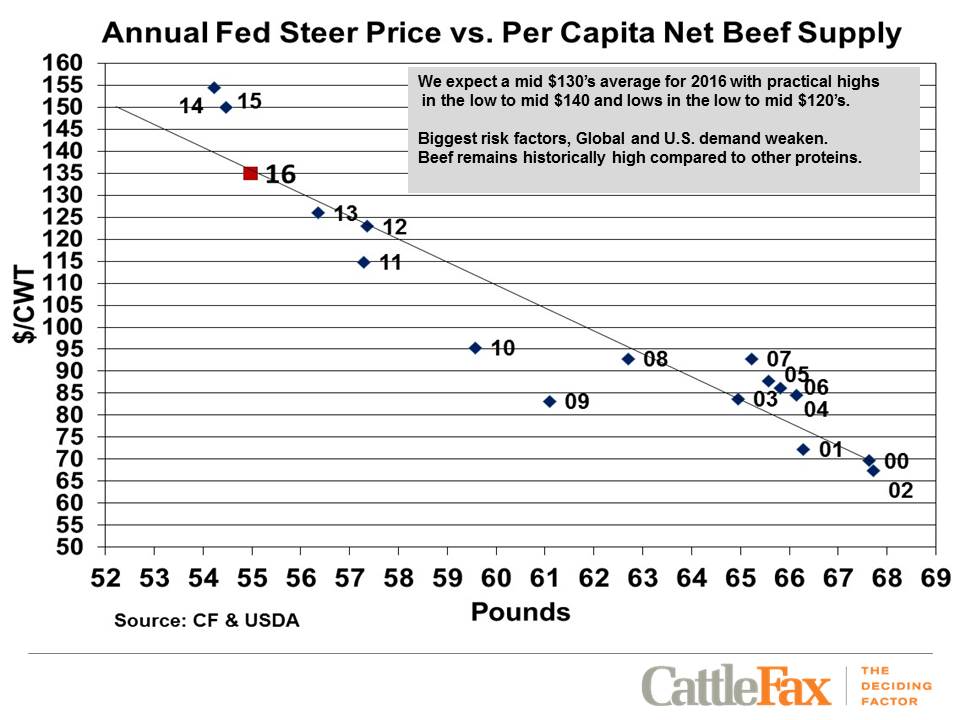

In the January supply/demand USDA report, economists projected fed cattle prices in 2016 will drop almost 8 percent compared with 2015, from a 2015 average above $148 to $132 to$142 this year. That still would be among the highest average prices in history, as the CattleFax chart illustrates.

Cow-calf business

As noted earlier, feeder prices followed fed cattle lower. For those seeking to enter the cow-calf business or rebuild herds, the cost is substantially more palatable than last year. However, industry growth has shifted from cow retention to heifer retention, according to Jim Robb, with the Livestock Marketing Information Center (LMIC).

“Cow culling rates have rebounded to historic norms – calf producers aren’t keeping older cows for one more turn,” Robb said.

Although cow-calf margins are shrinking, they are expected to remain positive in 2016. The LMIC calculates returns over cash costs plus pasture rent were $530 per cow in 2014, before falling dramatically to about $300 per cow in 2015 -- still the second-highest ever calculated by LMIC. The center projects an additional $100 drop per cow in 2016, bringing returns down to $200.

Wrap-up

Knowing some December close-outs resulted in losses of more than $500 a head, beef-focused lenders at FCSAmerica are watching the Association’s portfolio closely. But even as prices plummeted, feedlots with lines of credit through ABF had plenty of availability remaining of the $2 billion committed to that sector, Jesske said, noting that “most of our producers are very astute risk managers.”