OMAHA - (January 15, 2014) – Land prices and demand continue to be strong across a four-state area of the upper Midwest, but the latest data aggregated by Farm Credit Services of America (FCSAmerica) suggest the market for crop production farmland could be leveling off or in some cases softening.

“After years of a steady rise led by lower than average U.S. yields, strong domestic and international demand for commodities, low interest rates and solid profit margins, we’re seeing the rate of price increases leveling off for farmland in some areas we serve,” said Mark Jensen, senior vice president and chief risk officer for farmer-owned FCSAmerica. The financial services cooperative is a leading ag lender to farmers and ranchers in Iowa, Nebraska, South Dakota and Wyoming.

Jensen referred to two reports produced this month by the FCSAmerica appraisal team. The first is a semi-annual update of their Benchmark Land Values study, in which the lender has tracked the values of 65 farms for more than three decades. The second report is a compilation and analysis of more than 3,500 agricultural real estate sales transactions – both auctions and private sales – in all four states during 2013.

Average Change in Benchmark Farmland Values

as of January 1, 2014

|

State

|

Six Months

|

One Year

|

Five Years

|

Ten Years

|

|

Iowa (21):

|

-2.8%

|

3.4%

|

98.3%

|

282.1%

|

|

Nebraska (19):

|

0.7%

|

8.0%

|

143.2%

|

325.9%

|

|

South Dakota (23):

|

7.2%

|

17.6%

|

109.3%

|

325.7%

|

|

Wyoming (2):

|

3.4%

|

6.9%

|

-3.8%

|

75.2%

|

Source: Farm Credit Services of America. Numbers in parentheses indicate number of farms studied.

Both the benchmark report and the analysis of sales transactions suggest the market for farmland is leveling off and in some areas softening in FCSAmerica’s four-state region, Jensen said.

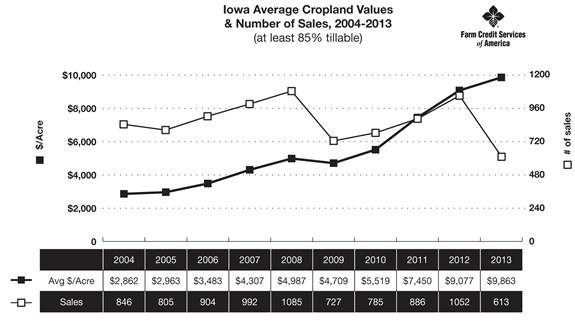

“There’s evidence that farmland prices may be on a slight decline from record highs seen at the end of 2012 and for most of 2013,” he noted. “Based on our benchmark study, Iowa land prices were down 2.8 percent in the second half of the year, and our review of real estate transactions showed Iowa land prices down 3.3 percent in the fourth quarter of 2013 compared to the third quarter. Nebraska benchmark farm value increases slowed to the lowest levels in several years, up just 0.7 percent.”

Demand Remains Strong

Land prices and demand for farmland continue to be strong in the four-state area, Jensen said, but buyer sentiment could be adjusting with decreased commodity prices that will reduce the record profit margins experienced the past few years.

“Even though the number of public land auctions in 2013 was down 25 to 30 percent compared to 2012, auctions were often well-attended with multiple bidders,” Jensen said. “The number of auction ‘no sales’ in Iowa was 6.7 percent in 2013, an increase from 3 percent in 2012. Some sellers may have expected higher prices than the auction high bid. Local farmers continued to make most of the purchases.”

Jensen said FCSAmerica’s data suggest customers are positioned to weather a moderate downturn in land prices.

“Since 2008 FCSAmerica has used a risk management strategy that includes a cap per acre on the amount of money we’ll loan for land purchases. We’ve been using a long-term sustainable value approach to projecting repayment and lending levels based on corn prices closer to $4.50 per bushel versus the prices of $7 or more that some farmers were receiving in 2012,” he noted. “Our customers understand the financial risks and volatility in the agriculture industry. Their balance sheets and working capital levels are generally in a position of strength, and they have put a significant amount of equity into land purchases.”

State-by-State Highlights:

Iowa

- Land continues to sell at all-time highs with premium ground generally bringing from $12,000 to as much as $17,000 per acre.

- The average price for unimproved cropland was $9,700 per acre in the fourth quarter, down from $10,100 in the second and third quarters. However, the average price of land was $9,800 for 2013, up 8 percent from $9,000 in 2012.

- There were approximately 30 percent fewer public land auctions in Iowa compared to 2012.

South Dakota

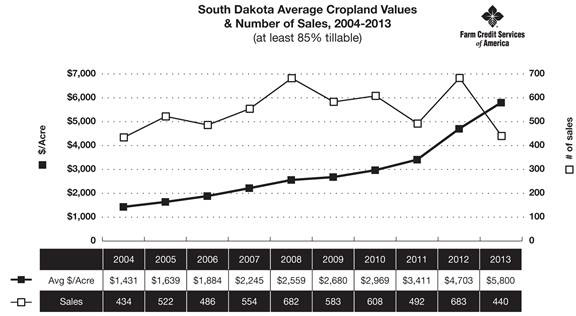

- January 2014 South Dakota benchmark land values were up 7.2 percent for six months and 17.6 percent for the year.

- South Dakota unimproved cropland values have steadily increased for the last three years and are currently selling at all-time highs with premium ground bringing up to $12,000 per acre.

- Land prices increased 12 percent to $6,500 per acre in the fourth quarter of 2013. For all of 2013, land prices averaged $5,800 per acre, up 19 percent from $4,700 in 2012.

Nebraska

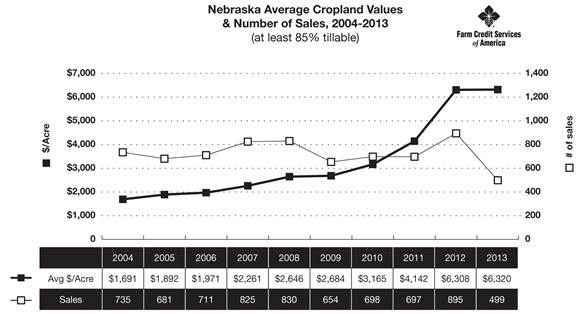

- Nebraska benchmark land values were up 0.7 percent in January 2014 compared to July 2013 and increased 8 percent for the year.

- Nebraska unimproved cropland values are measured separately for dry cropland and irrigated cropland.

- Nebraska dry cropland prices have had significant price swings over the last two years. For the fourth quarter of 2013, prices increased by 15 percent to $5,900 per acre. The price per acre for 2012 and 2013 was $5,500 on average.

- Nebraska irrigated cropland prices continued to rise, selling at all-time highs of $8,100 per acre. Land prices increased 6 percent during the fourth quarter of 2013. For all of 2013, prices were up 4.4 percent compared to 2012.

- Auction activity in Nebraska was off approximately 30 percent in 2013 compared to 2012.

Wyoming

- FCSAmerica’s Wyoming benchmark land values were up 3.4 percent over July and 6.9 percent for the year.

- Across the state sales were light, totaling 125. The diverse nature of the sales, and determining highest and best use, make it challenging to establish a trend. Considering those factors and the light sales data, pasture and unimproved cropland prices are about $750 to $1,500 per acre.

About Farm Credit Services of America

Farm Credit Services of America is proud to finance the growth of rural America, including the special needs of young and beginning producers. With more than $20 billion in assets, FCSAmerica is one of the region’s leading providers of credit and insurance services to farmers, ranchers, agribusiness and rural residents in Iowa, Nebraska, South Dakota and Wyoming. Learn more at fcsamerica.com.

# # #